School Fees Dividend Diversion – another bad lesson!

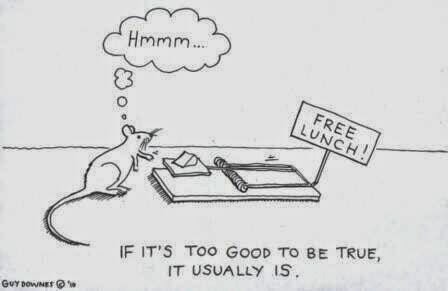

As a company we always warn clients of schemes. In the years we have been in business there have been many “promotors” of these schemes, with the schemes going bad and leaving the taxpayers exposed to additional tax and penalties having been sold the dream of tax efficiency. The old adage, “if it seems too good to be true, it probably is” generally applies.

The latest scheme to hit HMRC’s radar is in regards to school fees for children of owner managed businesses. This scheme is currently being marketed as a tax planning option but in HMRC’s view the scheme does not work.

So how does the arrangement work?

- a company issues a new class of shares which usually entitles the owner of the shares to certain dividend and voting rights

- Person A, usually a grandparent or sibling of the company owner, purchases the new shares for an amount significantly below market value

- Person A usually gifts the shares to a trust or declares a trust over the shares for the benefit of the company owner’s children

- Person A or the company owners vote for substantial dividend payments in respect of the new class of share

- this dividend payment is paid to the trustees of the trust

- as the beneficiaries of the trust, the company owner’s children are entitled to the dividend

The company owner’s children pay tax on the dividend received. However, they pay much less tax than if the company owners received the dividend due to their children’s:

- £12,570 tax-free personal allowance

- £1,000 dividend allowances

- eligibility to the dividend basic tax rate

HMRC’s view is that this scheme does not work as the arrangements are caught by specific anti-avoidance legislation contained in Income Tax (Trading and Other Income) Act 2005, from S619 onwards that prevents this type of arrangement providing the tax advantage that is sought.

Why does this fail?

The legislation in S619 onwards referred to above captures the diversion of income paid to unmarried minor children of the settlor – i.e. the parents in this scenario. The loss of tax yield to HMRC is significant due to the potential difference in tax rates payable by the parents and that ultimately as a minor children of the shareholders, the benefit is being retained.

Some of the key characteristic of schemes and their promotors:

- They have QC opinion – but not one that has been tested through the courts

- Fees will be based only on tax saving – so often a higher risk approach as this maximises their revenues

- Longevity is lacking – the companies promoting aren’t around for long, they make a shed load of money and then are not there by the time the proverbial hits the fan

This is just one of many schemes currently being marketed at the moment – as always our advice is – beware of schemes!